Guest Post: Financing Options for Solar Rooftop Projects in India

Solar power is experiencing rapid growth in India, powered by a variety of recent developments: central and state governments have been announcing policy initiatives to drive adoption, solar power is already at grid parity for SME & industrial customers in 12 states, and cost of grid power is increasing by 5 – 10% every year for almost all customers. Combined with environmental concerns and widely prevalent power deficits across the country, going solar should be top of mind for everyone.

However, despite compelling long-term benefits and positive environmental impact, we haven’t seen solar adoption going viral, especially among rooftop owners. Customer awareness and high capital costs are the largest hurdles in today’s marketplace. Given the rapidly changing environment, rooftop owners often lack clear, up-to-date, information. Bijli Bachao has previously produced an excellent guide to buying rooftop solar in India, here:

This video provides an overview of a rooftop solar system, tells you about the types and cost of such systems. It also provides information about additional factors that you should think about like system size, and how much roof space will it need.

The high initial cost of solar is becoming easier to address. For residences, housing societies, and small commercial establishments, loans are available at low EMIs under MNRE directive to banks to treat rooftop solar as a priority sector for lending. For establishments with large electricity consumption (>10,000 kWh a month), pay per unit financing deals are becoming available. Under such contracts, a third party owns the solar installation, and the roof owner enters into a long-term (10-20 yrs) agreement to purchase power generated by the system at a set rate. Capital cost to the owner is zero, they pay only for power used from the system and save from day-1. Some companies are offering leasing models, which are somewhere in between the two stated above. However, the market is changing quickly, and it is not easy to avail these schemes. Loan products are still evolving, and PPA and leasing models for rooftop solar are in nascent state.

Will a rooftop solar system save me money?

A key question that most potential buyers have is: will a rooftop solar system save me money? Of course, the answer depends on the type of connection, state and amount of usage. Let’s look at a couple of examples.

First, consider a small urban household that consumes 10 units (kWh) of electricity daily, with a 2 kW system installed on the roof. In 2015, this system would cost approximately INR 2 lakh to install. The lifetime of a typical solar system is 25 years. So, the system costs INR 8000 per year. A 2kW system should comfortably provide 8 units (kWh) of electricity per day. At INR 4 per unit, the monthly electricity bill goes from INR 1200 to INR 240, saving INR 11520 annually on electricity costs, and INR 3520 annually net of system cost.

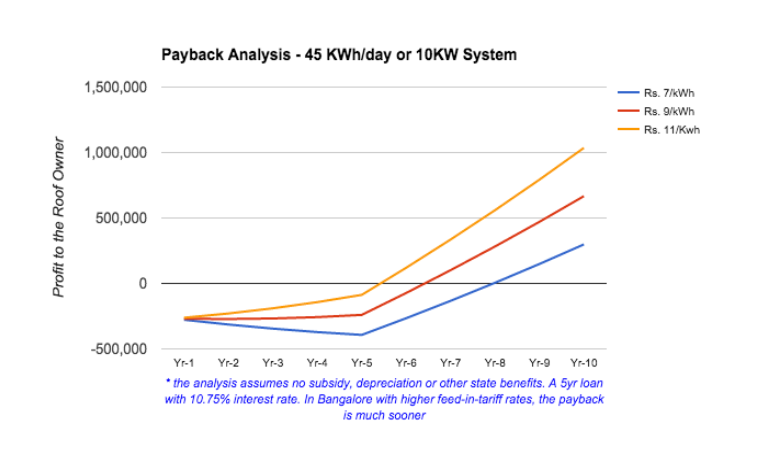

If you were to use financing for a rooftop solar system, you would be saving money net of EMI within a few years. Shown below is a payoff curve (net of EMI) for a 10KW system in Bangalore, financed with a 5 year loan at 10.75% interest rate.

It is important to note state and central government incentives are not factored into the calculation above. A profitable corporation can take advantage of accelerated depreciation benefits (writing off 80% of system cost in year 1) on their tax return. For solar loans to individuals and SMEs, MNRE is spending funds on lowering interest rates on loans. Lastly, while subsidies are available for rooftop solar from central and state governments, they are difficult to get as there is a priority list for approval. MNRE has advised people to set up rooftop projects without waiting for subsidies given constraints on availability of funds.

Oorjan Cleantech (http://oorjan.com), India’s first rooftop solar financing platform, can help you solve the capital cost hurdle. If you already have a price proposal and project design from an installer, send it to us for evaluation and financing. If you are just getting started, we can help you choose a highly rated local installer and obtain financing. Loan approvals for EMI schemes typically take 2-3 weeks, while pay-per-unit agreements take upto 6 weeks. We also provide a user-friendly app to monitor system performance once your project is installed, and provide periodic alerts. Contact us if you have always wanted to go solar, have questions and/or money was in the way!

This post is a guest contribution by Oorjan Cleantech, a company that enables solar rooftop financing. It is an initiative by Alums of IIT Bombay having years of experience in Solar PhotoVoltaic Markets. They have an estimator and contact form on their website www.oorjan.com.

About the Author:

Abhishek Jain is an Alumnus of IIT Bombay with almost 10 years of experience in corporate before starting Bijli Bachao in 2012. His passion for solving problems moved him towards Energy Sector and he is keen to learn about customer behavior towards Energy and find ways to influence the same towards Sustainability. More from this author.