Know Your Electricity Bill

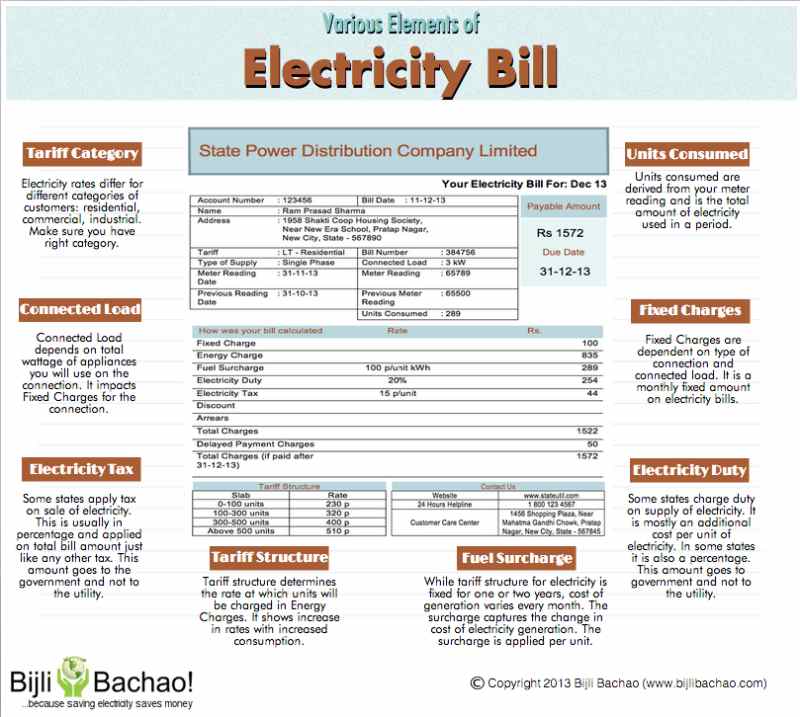

It is very important to understand the electricity bill and it’s components to make plans for energy savings. Our electricity bills have quite a lot of information to give us a good insight into our electricity consumption patterns. A good understanding of various components can help one plan for money-saving exercise. To know the tariff of each State applicable for the year in 2024, click here.

In this article, we will discuss various sections/information on electricity bills that are important:

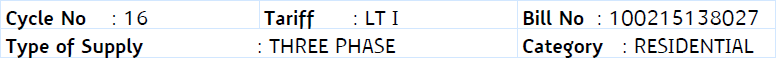

- Tariff / Category: Tariff and Category determine the rate structure applicable to the bill. Typical tariff codes start with LT (Low Tension 230V single phase or 400 V three phases) or HT (High Tension 11kV and above). LT codes are typically used for connection to residential, commercial and small offices. HT codes are typically used for bigger industries and complexes. Category in the bill determines if the connection is residential, commercial or industrial. Different rates/slabs are applicable for different tariff codes and thus it is important to validate that the right tariff code is applied on the electricity bill. This information is available on bill header as shown below:

- Type of Supply & Connected Load (Fixed charges of each State/DISCOM): Connected (or Sanctioned) Load is the total pool of supply that is given to a meter. This is calculated in kW (or Killo-Watts). This is the permissible total peak kW given to a meter based on the appliances connected to the meter. This is not your actual energy consumption and only impacts fixed charges on your electricity bill. Connected load also determines if the connection will be a single-phase or three-phase. If the actual load is more then the sanctioned load, then it will impact the fixed charges for that month and some DISCOM imposes a penalty of increased fixed charges for the incremental increase of the actual load drawn. Every DISCOM is having a method of calculating the load to be sanctioned to the applicant and should check the website of the company as it varies widely such as:

- constructed area

- assessment based on the load of the connected appliances and using redundancy factor

- based on the unit consumed in kWh

- and so on

- Below is a screenshot from Reliance Energy bill in Mumbai:

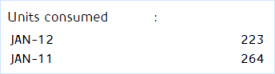

- Units Consumed (Unit rates of each State/Discom): Units consumed is the number of kWh (Kilo-Watt-Hour) consumed in a month. 1 kWh is equivalent to keeping a 100 Watts bulb on for 10 hrs. This information is calculated by finding the difference between meter readings of two consecutive months. This is the total monthly consumption by all the appliances that are connected to the meter. This is the value that needs to come down in order to reduce the electricity bill. An observation of consumption history can give an indicator of the appliances having higher electricity consumption (typically Air Conditioners increase consumption in summers). In case you want to check the likely energy consumption in units (kWh) based on the information of appliances connected in your house and average daily consumption, you may use this link.

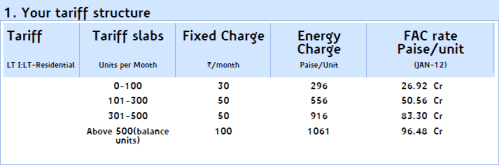

- Tariff Structure: It is very important to note the tariff structure on your bill, as this is the best indicator of how the bill can be reduced. Typically for residential and SMB commercial connections, the structure is slab based (unlike industrial connections where units are charged at a high flat-rate). The intent behind the slab structure is to reward low energy users and charge extra to those who have high consumption. The slabs are based on the “Units Consumed” that we discussed earlier. As the number of units consumed increase, energy charge changes and also the fixed costs associated (single-phase) with the slab increases. Below is a sample of tariff structure from a bill from Mumbai:

- Fuel Adjustment Charge (FAC): As you can see in the tariff structure above, there is a FAC rate applicable at each slab. This is the additional cost of power incurred due to fuel price increments during a year. Fuel in most cases is Coal. As per a study, after 2011, the production rates of coal will decline, reaching 1990 levels by the year 2037, and reaching 50% of the peak value in the year 2047. So invariably FAC will increase till alternate sources of electricity are not developed to a state where they can generate electricity that cheap. So electricity costs will surely increase in future.

- Electricity Duty/Taxes (applicable taxes of each State): Every state is having an Electricity (Duty) Act wherein the applicable taxes for different tariff structure is defined and one can check the same in his electricity bill. It may be noted that this tax is not under the purview of GST as one date. The taxes applicable in Rajasthan (for example) of the different category is given below:

Industrial including mining 5 p/unit Agriculture (i) In the case of metered supply

(ii) In the case of non-metered supply

1 p/unit

5% of the flat rate

Commercial, domestic and others 6 p/unit Consumption under temporary connection 15 p/unit Consumption of self-generated energy of any purpose 6 p/unit

Understanding the elements of electricity bill mentioned above can help you understand your electricity bill and will also help you to plan your electricity consumption reduction project. Two things that should be targeted are Units Consumed and Connected Load. Reduce the two and your electricity bill will surely come down along with the impact of taxes and Fuel Surcharge.

About the Author:

Abhishek Jain is an Alumnus of IIT Bombay with almost 10 years of experience in corporate before starting Bijli Bachao in 2012. His passion for solving problems moved him towards Energy Sector and he is keen to learn about customer behavior towards Energy and find ways to influence the same towards Sustainability. More from this author.